what is tax planning explain its characteristics and importance

Planning is firmly correlated with discovery and creativity. Every taxpayer wishes to retain a maximum part of the earnings rather than parting with it and facing.

Tax Planning Meaning Strategies Objectives And Examples

Full advantage of tax.

. I Reduction of tax liability. What is tax planning explain its importance. It ensures savings on taxes while simultaneously conforming to the legal obligations and.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Tax planning is a focal part of financial planning. Heres a quick rundown of some of the benefits that a good tax payment plan holds.

Income Tax Definition And Characteristics Qs Study. It aims to reduce ones tax liabilities and optimally utilize tax exemptions tax rebates and benefits as much as. Reduction in tax rates.

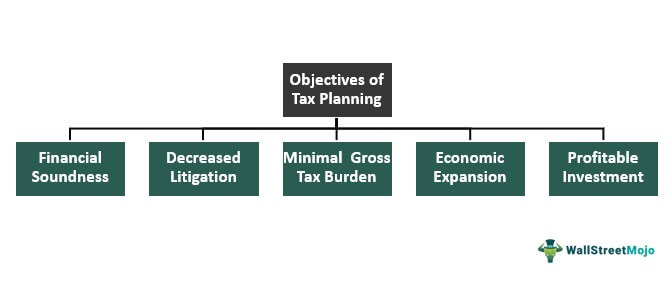

Tax planning refers to the process of organizing ones financial affairs in order to minimize the amount of tax payable. The main objectives of tax planning. Tax planning is critical for budgetary.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Tax planning is crucial for budgetary efficiency. Tax planning is the logical analysis of a financial position from a tax perspective.

The prime objectives of tax planning are. Tax planning refers to financial planning for tax efficiency. What is tax planning explain its characteristics and importance Monday May 30 2022 Edit.

Hence the objective of tax planning cannot be regarded as offending any concept of the law and subjected to. Reduction in tax bills. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc.

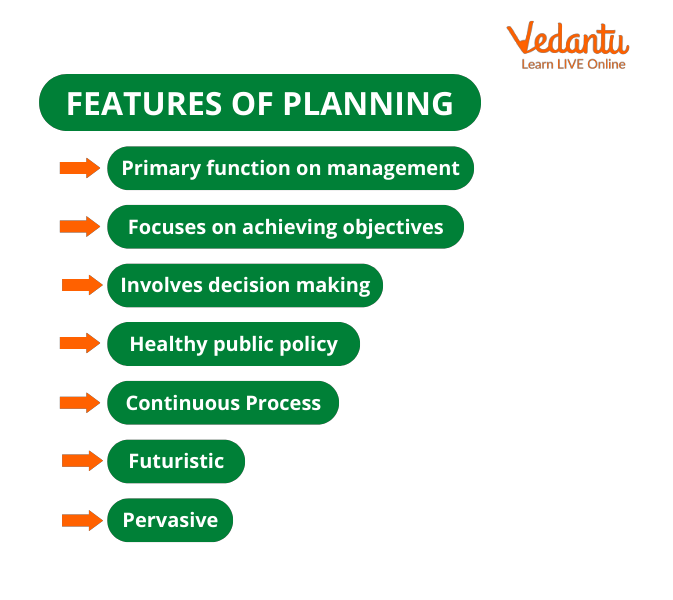

It involves making decisions about which income and. Importance of Planning. In this type the provision is done in an intelligent way to avail the tax benefits while following a certain well-defined objective such as a change in investment.

Tax planning allows all elements of the financial plan to function in sync to deliver maximum tax efficiency. Answer 1 of 10. Greater control over payments.

Authorities like the IRS implement legal measures and regulations to ensure citizens. The main objective of tax planning is to reduce ones tax liability.

Nta Ugc Net Set Exams Part 11 Objectives And Types Of Tax Planning In Hindi Offered By Unacademy

How To Write A Business Plan In 10 Steps Free Template Article

8 Key Elements Of A Business Plan You Need To Know

4 Types Of Business Structures And Their Tax Implications Netsuite

What Is Tax Planning Definition Objectives And Types Business Jargons

4 Types Of Business Structures And Their Tax Implications Netsuite

Sole Proprietorship Definition Features Characteristics Advantage Disadvantages

Tax Planning Meaning Characteristic And Objects Youtube

Tax Planning Know Scope And Importance Of Corporate Tax Planning

Planning Definition Characteristics Limitations Process And Faqs

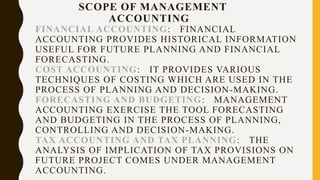

Management Accounting Meaning Definition Characteristics Scope

Major Characteristics Of Investments Mba Knowledge Base

Arb Preliminary Site Plan Checklist July 2010 Pdf Albemarle County

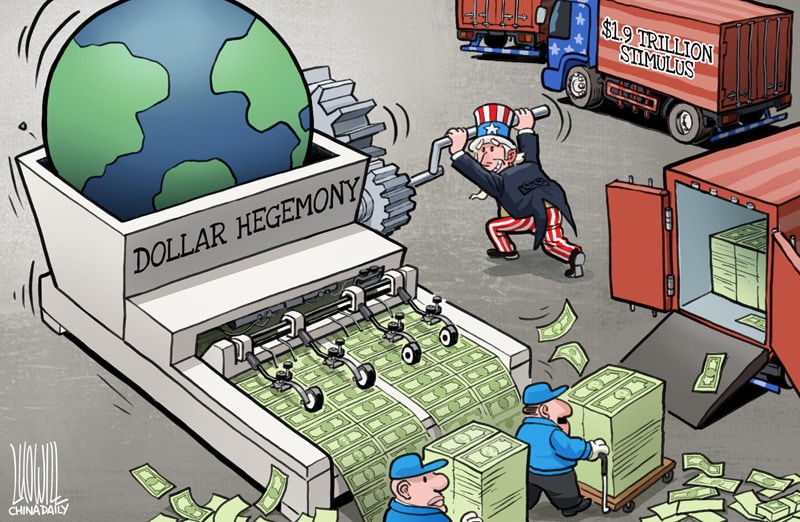

Monthly Review Five Characteristics Of Neoimperialism

What Is The Earned Income Tax Credit Tax Policy Center

What Is An Entrepreneur Entrepreneur Examples Characteristics Video Lesson Transcript Study Com

:max_bytes(150000):strip_icc()/Term-Definitions_descriptive_statistics_FINAL-291754f47e4e49e899ec7f0d42dcbab6.png)

:max_bytes(150000):strip_icc()/Term-b-business-plan_Final-dae30f31c14b4169958caa924fd5786d.png)